AlgoTrader

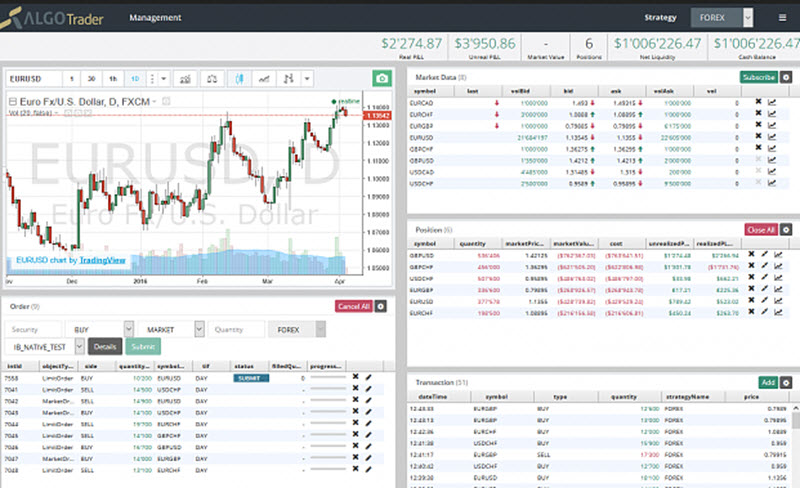

The AlgoTrader software enables automated trading on forex, cryptocurrency, stocks, options, futures, and commodities markets. It is a powerful aid that can help you automate your trading and execute numerous strategies simultaneously.

The AlgoTrader software enables automated trading on forex, cryptocurrency, stocks, options, futures, and commodities markets. It is a powerful aid that can help you automate your trading and execute numerous strategies simultaneously.

The AlgoTrader is offered by AlgoTrader GmbH, a company based in Switzerland. This is a renowned pioneer in the field and it has contributed greatly to the increased popularity of automated trading on the retail-trader marker.

AlgoTrader has been around since 2009, and has of course been updated and improved continuously over the years. Instead of simply keeping up with the trends, AlgoTrader is known to be somewhat of a trailblazer in the world of automated trading.

Interestingly, the AlgoTrader is built on open-source technology, frameworks and methodologies, including Java SE 6 Model Driven Architecture and the AndroMDA CEP-Engine for code generation.

Why has AlgoTrader become so popular?

Here are a few examples of reasons behind AlgoTrader´s popularity among the online traders.

Can process large volumes of data in a short period of time

AlgoTrader utilizes the Esper engine and can quickly process high volumes of market data.

Dependability

AlgoTrader is built in a robust fashion and known to be reliable.

Adaptability

You can customize AlgoTrader in many different ways to suit your own needs and preferences.

Integration

AlgoTrader is compatible with a wide range of third-party resources, including third-party libraries.

Automatic rolling

It is possible to use automatic rolling to continuously trade futures and options

Time-based window functions

Examples of available time-based window functions are during, between, afterwards, parallel with, along with, finishes, and begins.

Get the best from Java and Esper

With AlgoTrader, you can enjoy the best from both Java and Esper. Java is for instance great for procedural actions (e.g. place your order) while Esper is excellent for time-based market data analysis.

Other examples of popular features in the AlgoTrader 4.0

- Multicolumn grouping

- It is possible to display all tables at once

- Alarms and notifications can be used to keep you on top of things

- Live market data is updated in real-time (no need to refresh to see it)

- It is possible to fully customize the Execution Model for backtesting.

Interfaces and adapters

AlgoTrader 4.0 supports 15 interfaces and adapters, including the popular Nexus Prime, Quandl, Coinigy, and QuantHouse.

You can extend the HTML5 user interface with a number of strategy-specific customized widgets to better visualize strategy-specific data. Widgets are created with JavaScript and empty web sockets over STOMP.

Can AlgoTrader be used for algorithmic Bitcoin trading?

Yes it can, through integration with Coinigy. Also, AlgoTrader is not just for Bitcoin trading, you can use it for hundreds of different cryptocurrencies, including bit ones such as Dash, Ripple and Ether (Ethereum).

Examples of available exchanges: OKCoin, Kraken, Bitfinex, Bitstamp, Poloniex

Cryptocurrencies can be traded against each other, or against traditional currencies such as USD via forex brokers.

Tips! If you are interested in this field, also look into how you can use AlgoTrader for arbitrage trading between exchanges and for automatic rebalancing of portfolios.

Storing market data

To store live and historical market data, AlgoTrader utilizes the databse InfluxDB, which allows for storage of up to one million values each second. Advanced compression limits the storage footprint.

If you want to, you can do accelerated back-tests (up to 200 percent).

Technical analysis

AlgoTrader comes with charting capabilities, but they are fairly limited. Examples of available chart types are lines, bars, area, candles, and selected linear.

The TradingView chart library gives you access to a series of indicators, such as Bollinger Bands, Keltner, Donchian, and Parabolic SAR.